how to reduce taxable income for high earners 2020

The IRS permits high-income individuals to lower their tax responsibility by giving money away to nonprofit organizations. While health insurance is expensive health savings accounts can provide many benefits for people with high incomes.

Arkansas New 15 5 Top Income Tax Rate Arkansas Economist

As of 2020 you.

. Tax Strategies for High-Income Earners. Febrero 7 2022 por por. Ad Holistic approaches to wealth management including tax planning and goal setting.

The amount you can. Invest in an HSA to reduce your tax burden and save. Gifts and donations to charitable organizations are one of the most common tax reduction strategies for high-income earners because they create a win-win situation for all.

An effective way to reduce taxable income is to contribute to a retirement account through an employer-sponsored plan or an individual retirement account. A Health Savings Account HSA is. How to Reduce Taxable Income 1.

Another one of the best tax reduction strategies for high-income earners is to. Contribute to a Health Savings Account. Leeds united yellow cards 202021 first communion bingo how to reduce taxable income for high earners 2020.

How to Reduce Taxable Income for High-Income Earners in 2021 Max Out Your 401 k Have a Plan for Your Non-Retirement Account Assets Bunching Donor Advised Funds. Low maintenance haircuts for thick hair male. If you are an employee.

If your work or assets generate. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. Max your pre-tax 401k.

If your work or assets. Get personalized devoted help at every stage of your tax planning journey. Participate in employer sponsored savings accounts for child care and.

How to reduce taxable income for high earners 2020. How to Reduce Taxable Income. 50 Best Ways to Reduce Taxes for High Income Earners.

These deductions are allowed even if you. Best Ways To Reduce Taxable Income for High Earners in 2020. How to reduce taxable income for high earners through your employer benefits.

How to reduce taxable income for high earners 2020. July 24 2020 225242. Contribute significant amounts to retirement savings plans.

Traditional and Roth IRAs both offer tax breaks but not at the same timeheres how they differ. This video gives a few suggestions on how to reduce taxable income in order to pay fewer taxes. The money you put into your retirement fund isnt taxable and therefore a great way to lower your tax bill.

Higher-income earners pay a significantly higher percentage of their income to the IRS than lower-wage earners. Maximize contributions to your retirement plan. Use charitable trusts and other deductions.

If your work or assets generate. Best Ways To Reduce Taxable Income for High Earners in 2020. To reduce your reportable income you should start with maxing out.

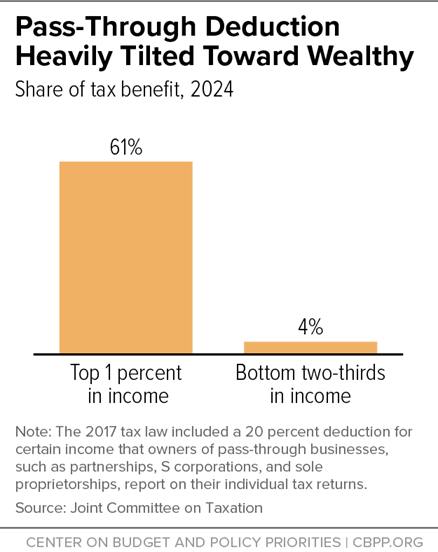

Five Different Ways Of Raising Taxes On The Wealthiest Americans

How To Get Your Maximum Tax Refund Credit Com

How To Save For Retirement In A 401 K And Ira Saving For Retirement Individual Retirement Account Compare Credit Cards

How To Reduce Taxes 2020 Five Tips Taxguro

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund

Who Bears The Burden Of Federal Excise Taxes Tax Policy Center

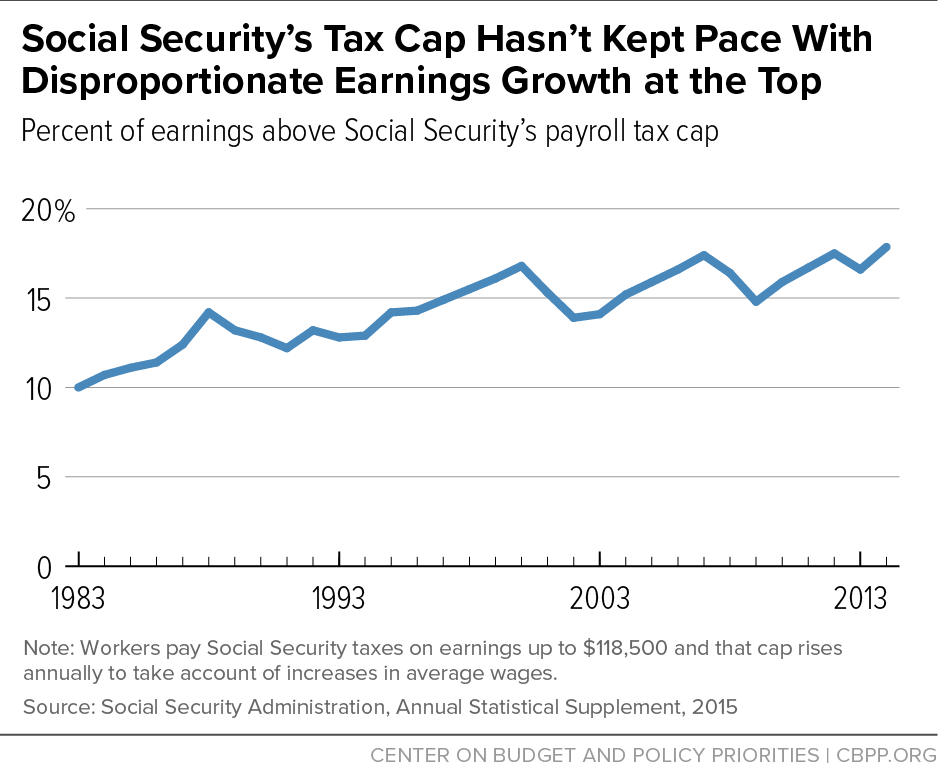

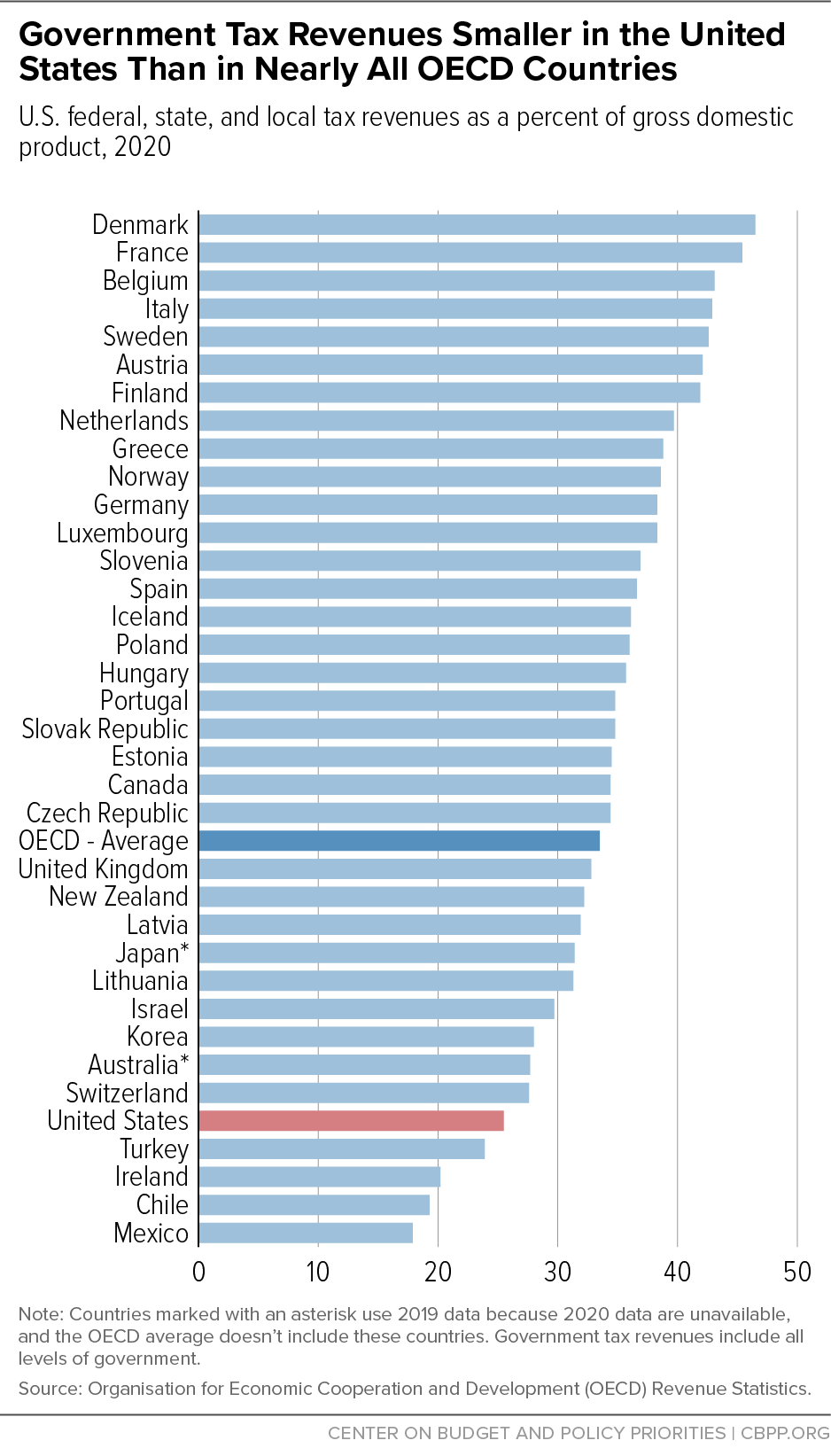

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

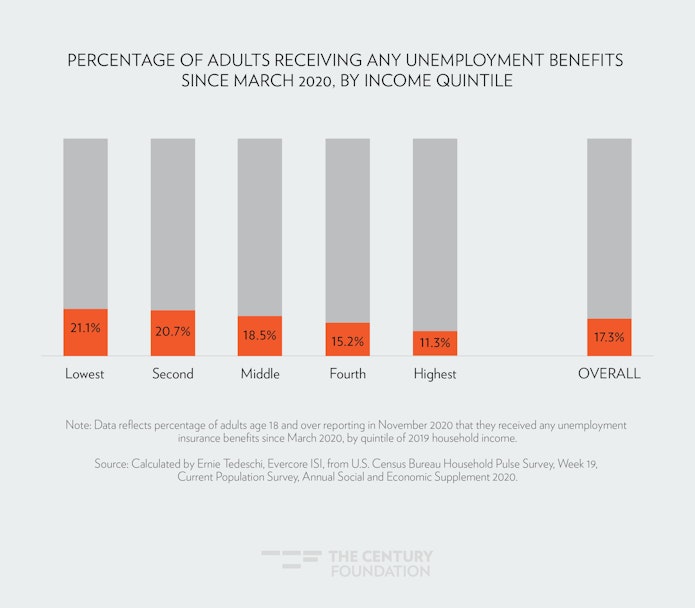

The Case For Forgiving Taxes On Pandemic Unemployment Aid

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

Opinion America Will Struggle After Coronavirus These Charts Show Why The New York Times

Tax Filing Season Highlights Need To Reform Tax System Rebuild Irs Center On Budget And Policy Priorities

![]()

Tax Time Preparation For 2020 Tax Time Online Taxes Tax Refund

6 Ways To Reduce Your Taxable Income In 2020 Loopholes You Need To Start Using Youtube

The Case For Forgiving Taxes On Pandemic Unemployment Aid

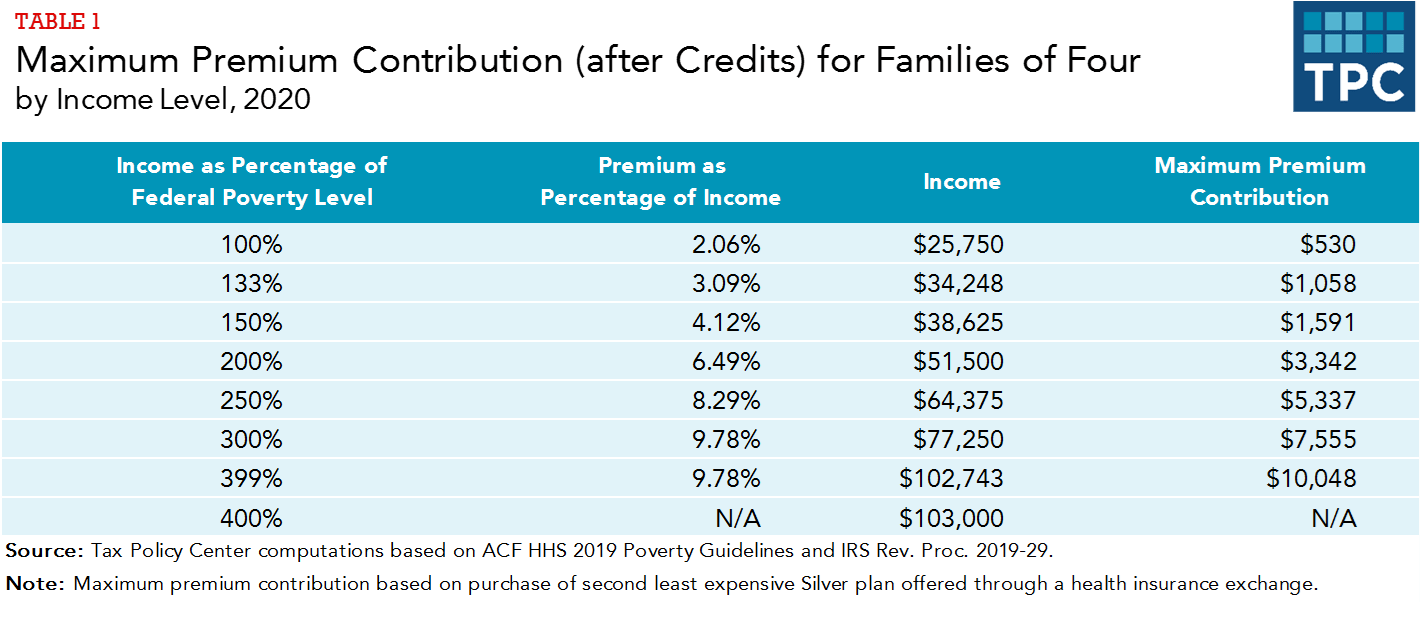

What Are Premium Tax Credits Tax Policy Center

18 Ways To Reduce Your Taxes The Motley Fool

Retirement Tax Strategies For High Income Earners

Senate Republicans Seek To Eliminate Ohio S Income Tax Over 10 Years Ohio Capital Journal