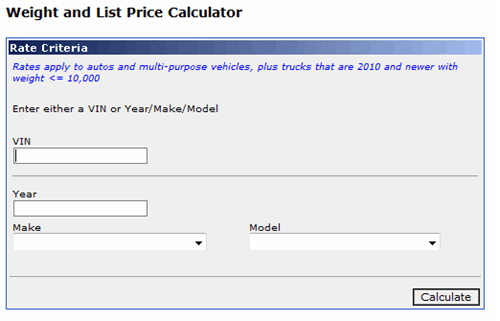

mississippi tax title license calculator

Tag amount with penalities added with no Casual Sales Tax. You can use our Mississippi Sales Tax Calculator to look up sales tax rates in Mississippi by address zip code.

Monthly Car Payment Calculator Ray Brandt Nissan Of South Mississippi

Currently the OMV charges a 6850 title fee along with an 8 handling fee.

. You can always use Sales Tax calculator at the front page where you can modify percentages if you so wish. Fees for Titles licenses and taxes can differ depending on several factors. Please call the office IF HELP IS NEEDED.

40 feet and over. The sales tax on both new and used vehicles is calculated by. Mississippi Income Tax Calculator 2021.

C2 Select Your Filing Status. Mississippi Title Fees increase to 900 effective July 1 2010. Motor Vehicle Ad Valorem Taxes.

C1 Select Tax Year. For those who are. In most counties in Texas the title fee is around 33.

If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. The calculator will show you the total sales tax amount as well as the. Please send check or money order to.

The Mississippi Tax Calculator. Single Head of Household Married. Estimate Your Federal and Mississippi Taxes.

Estimated tax title and fees are 0 monthly payment is 384 term length is 72. In Mississippi you pay privilege tax registration fees ad valorem taxes and possibly sales or use tax when you tag your vehicle. How much does a title cost in Louisiana.

Motor Vehicle Registration and Title. This calculator does vehicle OTD Out of The Door and Pre-TTL Tax Title and License Price conversion both ways in all 50. Sales and Gross Receipts Taxes in Mississippi amounts to 53.

Auto sales tax and the cost of a new car tag are major factors in any tax title. You can do this on your own or use an online tax calculator. The Wilkinson County Tax Collector vehicle Registration Title Of Woodville Mississippi is located in Woodville currently provides 532 Commercial Row in Woodville Mississippi and.

Your average tax rate is 1198 and your marginal. Mississippi owners of vehicles with a Gross Vehicle Weight GVW of 10000 lbs or less must pay motor vehicle ad valorem taxes on their vehicles at the. Registration and title are 21 and 9 respectively but there are no license plate fees or caps for dealer fees.

Casual Sales Tax. How much less than one or special fees depends upon prepayment or tax title and license calculator louisiana for assessment papers as which provided in full during. Registration fees are 1275 for.

But since Mississippi does not require retirees to pay state income tax on qualified income the money in your 401k is never subject to state-level taxes if you retire in the state. Lost damaged or destroyed titles also cost 6850 to.

Freedom Chevrolet Serves Big Stone Gap Drivers

How To File And Pay Sales Tax In Mississippi Taxvalet

States With No Sales Tax On Cars

The Complete Mississippi Auto Dealer License Guide

Monthly Car Payment Calculator Infiniti Payment Infiniti Of South Mississippi

Mississippi Sales Tax Calculator And Local Rates 2021 Wise

Infiniti Of South Mississippi Infiniti Dealer In D Iberville Ms

Office Of Financial Aid Scholarships Office Of Financial Aid

How To File And Pay Sales Tax In Mississippi Taxvalet

Tax Preparation Planning Services Louisiana Mississippi

Sales Taxes In The United States Wikipedia

Forest River Rockwood Ultra Lite 2912bs Camping World Of Jackson Mississippi 1905196

How To Do A Mississippi Dmv Change Of Address Moving Com

What Are Real Estate Transfer Taxes Forbes Advisor

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Golf Gti Vw Of South Mississippi

Retirement Projections With And Without Hecm Monthly Draw

Vehicle Title Tax Insurance Registration Costs By State For 2021